About Strategies for Paying Off High-Interest Debts First in South Africa

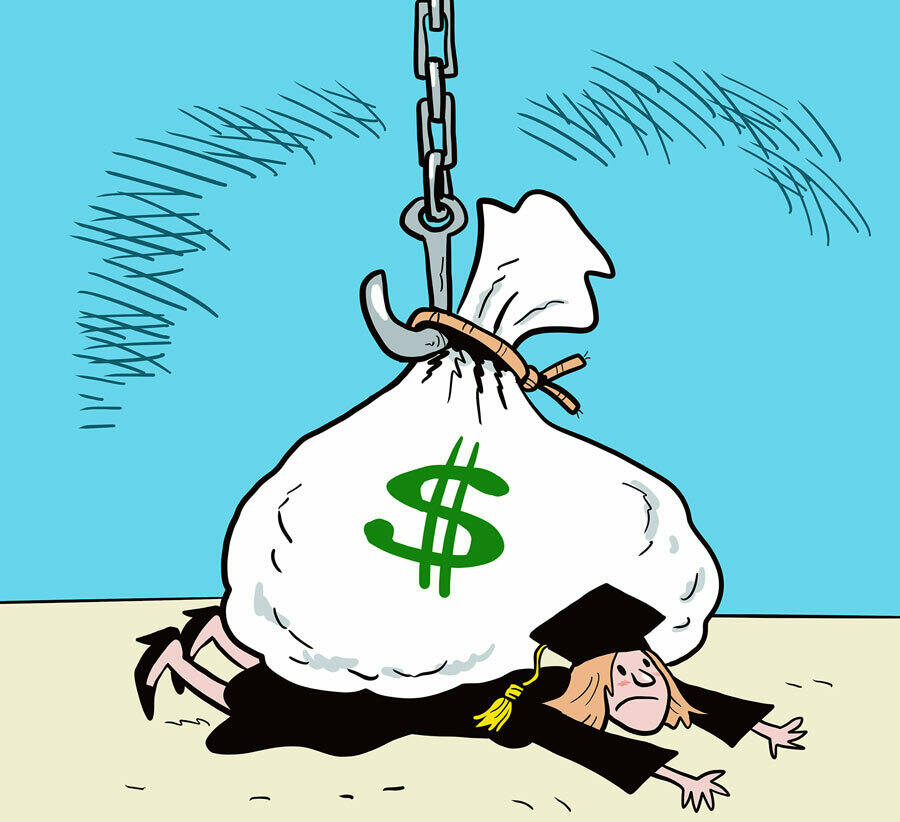

Debt is an concern that beleaguers millions of individuals around the world. It can be frustrating, nerve-racking, and fiscally debilitating. Lots of folks turn to professional companies to aid them obtain out of personal debt. However, some individuals like to take the do-it-yourself (DIY) technique and tackle their personal debt on their very own. In this message, we will certainly explore whether it is feasible to obtain out of debt on your very own and what DIY remedies are offered.

First and foremost, it's crucial to recognize that obtaining out of financial debt on your own is possible. People have efficiently performed it in the past, and you can easily also. Nevertheless, it's important to know that carrying out so requires a notable volume of initiative, technique, and devotion.

One of the most efficient DIY solutions for obtaining out of personal debt is developing a finances and sticking to it. The Most Complete Run-Down allows you to track your profit and expenses precisely. By doing therefore, you may determine areas where you're overspending and create required changes.

To generate a finances, start through listing all your sources of revenue and all your expenses. Your expenses ought to feature everything coming from rental fee/home loan settlements to electrical costs and even entertainment expenses such as dining out or streaming subscriptions.

Once you have detailed all your expenditures, categorize them in to essential (e.g., housing expense) vs. non-essential (e.g., amusement expense). This are going to aid you focus on which places demand additional interest when reducing back on investing.

Upcoming action is setting up a repayment planning or a snowball strategy for paying off financial obligations beginning along with those along with much higher enthusiasm fees first while producing minimum payments on others until they are paid out off completely prior to relocating onto higher-interest fee personal debts once more.

An additional DIY solution for getting out of debt is arranging along with lenders straight. If you're straining along with high-interest prices or ungovernable regular monthly payments due to credit report card debts or loans etc., make an effort talking to your collectors straight through phone or e-mail handle offered through them in order to bargain better phrases.

This can easily be a daunting possibility, but it's worth the initiative as it can easily result in lesser passion rates or also waiver of overdue remittance fees. Only always remember to be truthful regarding your economic scenario and present a sensible repayment program that suits each events.

An additional technique to acquire out of financial debt on your very own is with financial debt unification. Financial debt debt consolidation involves taking out a car loan with lower rate of interest rates to pay for off all your existing personal debts at once. This leaves behind you with merely one month-to-month settlement, producing it much easier to deal with your financial resources and stay clear of missed repayments.

However, financial obligation debt consolidation is only favorable if you can easily get a financing with beneficial terms and low-interest rates. Consequently, research extensively just before deciding on this choice and create sure you comprehend all the conditions and health conditions connected with the car loan.

While DIY solutions for getting out of debt may be reliable, they are not without their problem. For instance, it needs self-discipline and dedication over an extended duration of time. And occasionally DIY solutions may not operate for everyone due to variables like higher degrees of debt or restricted profit sources etc., which may require specialist solutions such as credit history counseling or insolvency submitting as an alternative.

In final thought, obtaining out of personal debt on your own is possible but demands willpower and dedication over an extensive time period of time. DIY solutions like making budget plans, working out along with collectors directly, or consolidating debts are reliable techniques to take on financial obligation on your very own. Nonetheless, if these answers don't work for you as a result of to factors like high amounts of debt or limited earnings resources etc., don't hesitate to find expert companies such as credit therapy or personal bankruptcy submitting as an alternative.